Tips to Close Your Fundraise by End of Year

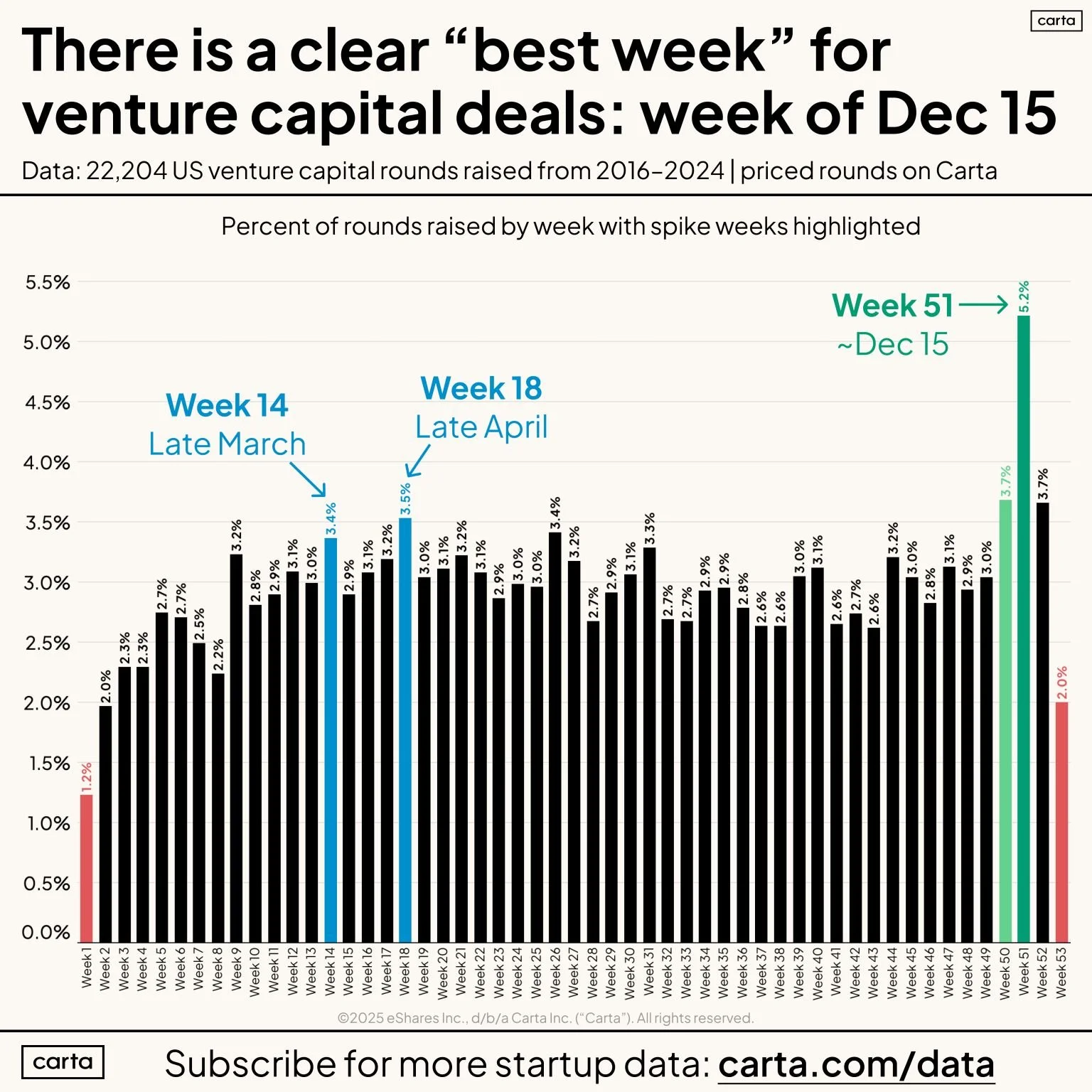

Thinking about raising funds before year-end? You're not alone. Carta’s latest data shows a massive spike in venture deals closing the second-to-last week of the year, making mid-December a busy time for venture capital deals. This reflects the convergence of investor budget cycles, founder urgency, and the psychological pull of the calendar. For founders planning to raise before the year ends, the next few weeks will determine whether your round closes smoothly in December or slips into Q1.

While momentum builds in December, it's the companies who have their legal and operational infrastructure ready who manage to get deals across the finish line before the holidays. Here are four essential tips that will position you to capitalize on the year-end fundraising window.

1. Build a Diligence-Ready Data Room Now

Diligence moves fast, especially if the parties are motivated to close quickly. Your data room should be complete and organized as early as possible, ideally before you sign a term sheet.

What should be in your data room:

Clean cap table: Complete ownership history with all issuances (including any prior issuances of equity, notes, SAFEs, etc.), transfers, and option grants clearly authorized and documented

Corporate governance documents: Certificate of incorporation, bylaws (or operating agreement for LLCs), all amendments, and board resolutions

IP assignments: Executed intellectual property assignment agreements (often called a PIIAA or CIIAA) from every employee, and a signed agreement containing an intellectual property assignment clause for any contractors (often built into a consulting or advisor agreement)

Material contracts: Key customer agreements, vendor contracts, partnership deals, and any documents with significant financial or strategic implications

Board materials: Recent board decks showing financial performance, metrics, and strategic direction

Organization matters: Create a logical folder structure with clear naming conventions. Ask Elego or your company counsel if they have a standard document request list and use that as the basis for your organizational structure.

Common gaps that can delay deals: Missing IP assignments, option grants that were never formally approved by the board, and cap tables with names or numbers that don't reconcile with underlying documents are red flags that will almost certainly surface during diligence and can significantly slow things down.

2. Decide Your Deal Structure

The structure of your raise can significantly impact closing speed. Changing your structure mid-process can also add weeks of delay.

The SAFE timing advantage: A financing on Y Combinator's standard SAFE documentation can typically close the fastest (often in a matter of days to weeks once the terms are agreed, assuming the signatories are available). The documents are standardized, generally understood and accepted by investors, and require minimal negotiation.

When investors want a priced round: Some investors, particularly those deploying larger checks or leading rounds, will push for a priced equity round with preferred stock. This means negotiating a term sheet, drafting a suite of documents to create a new class of preferred stock and investor rights, and amending the company’s charter. This process typically takes a minimum of 3-6 weeks, even with experienced and reasonable counsel.

Questions to resolve upfront:

Are you willing to accept a SAFE, or do you need priced equity?

If priced, are you using NVCA standard forms or custom documents? NVCA standard forms are likely to be much faster to negotiate given that investors and their counsel tend to understand the framework already.

3. Keep Tabs on Corporate Approvals

Confirm with company counsel what approvals are needed. Most financings require board approval at minimum. Depending on your charter, the size of the round, and the deal structure, you may also need stockholder approval. Review your governance documents early to ensure you understand what’s required.

Board and stockholder consents typically take longer to execute when people are traveling, and December is peak travel season. A single missing signature from a board member on a beach in Tulum can push your closing into next year.

Identify your signatories: Who needs to sign? Are any of them planning to be off-grid during the holidays? For board members or stockholders who will be traveling, consider these strategies:

Early execution: Obtain signatures on consent forms early and hold them in escrow, with the understanding that they'll become effective upon closing.

Electronic signature platforms: Ensure everyone is familiar with any signature collection platform that will be used (e.g., DocuSign, AdobeSign, HelloSign, or LiteraTransact).

Backup communication: Get personal cell numbers and alternative email addresses.

Timeline: Start the approval process as early as possible. Don't assume you can get everyone to sign in 48 hours during holiday week.

4. Finalize and Organize the Investor Syndicate

In most rounds, a lead investor is identified early, but it's still important to finalize the allocations for the rest of the round. Each additional investor adds signature packets and potential delay points like diligence or side letter requests. Finalizing who will participate in your round, and on what terms, as early as possible facilitates a faster closing.

A few key strategies:

Align with your lead investor: Understand their expectations for the composition of the rest of the investor syndicate and whether there are minimum investment requirements for the round (whether contractually or as an investor preference).

Consider a rolling close structure: If you have committed anchor investors but are still filling out the rest of a round, a rolling close may allow you to take investments from early investors while continuing to bring others in. This requires careful documentation and securities law compliance, so you should discuss the structure with your counsel before committing to it. This should also be socialized with your lead investor, including how much capital must come in the initial closing to begin the rolling close period.

Understand investors' closing requirements: Before setting a closing date, understand what each investor needs to close. For example, some funds have capital call periods of 5-10 business days or longer before funds can be wired. If this is the case, it’s important to track the timeline for capital calls that may affect closing and understand what that investor requires in order to initiate the capital call. Some investors may have other closing procedures that require specific versions of final documents (e.g., fully executed and compiled round documentation before wiring). These steps can cause small delays, so it is helpful to understand the full landscape of closing requirements when targeting a closing date.

Provide wire instructions early: Share accurate wire instructions with all investors well before closing. Missing or incorrect payment details can prevent funds from being transferred on time, even if all documents are signed. Proactively distributing and confirming these instructions helps avoid last-minute delays and ensures the company can close promptly.

The Bottom Line

Carta's data shows a clear pattern: for nearly a decade, mid-December has been the busiest time of year for venture deal closings. This trend reflects real market dynamics like investor urgency, budget cycles, and the psychological power of year-end deadlines.

The companies who successfully close in this window tend to have momentum and be prepared. They have clean data rooms, clear deal terms, their pulse on the key people for corporate approvals, and coordination over the investor syndicate.

References and Sources:

Carta Venture Deal Timing Data: Analysis of priced round closings by week (2016-2024), showing concentration during December 15 week. Referenced via LinkedIn post by Peter Walker, Carta.

Y Combinator SAFE Documentation: Standard Simple Agreement for Future Equity forms. Available via Y Combinator.

NVCA Model Documents: National Venture Capital Association standard financing documentation for priced rounds. Available via NVCA.