Insights

Decoding the NVCA Term Sheet (Part I): Understanding the Economics

This post is Part I of a two-part series decoding the “NVCA” term sheet. Here, we focus on the economic terms that determine ownership, dilution, and exit proceeds.

Flipping to Delaware: What Non-U.S. Founders Need to Know

This post walks through what a Delaware flip actually involves, why U.S. investors often require it, and where complexity tends to arise in practice. We also cover timing considerations, key tax and compliance issues founders should understand, and what comes next once the restructuring is complete.

The New Standard for Investor-Side Legal Representation in VC Financings

Instead of replacing lawyers in venture financings, AI is transforming legal work by eliminating inefficiencies so experienced counsel can deliver faster, better, and more cost-effective outcomes that meet investors’ fiduciary and regulatory obligations.

Stock Options Decoded: Equity Compensation Fundamentals

In this post, we dive into the fundamentals of stock options: how stock options are granted, how vesting schedules work, what acceleration means, the difference between ISOs and NSOs, how strike prices are determined, what it means to early exercise, and what happens to options upon termination.

Basics of Founder Compensation (Part II): Secondary Liquidity

In the second installment of our Founder Compensation Series, we break down the modern liquidity tools that allow founders to responsibly monetize a portion of their equity before an IPO or acquisition, without undermining company or investor alignment.

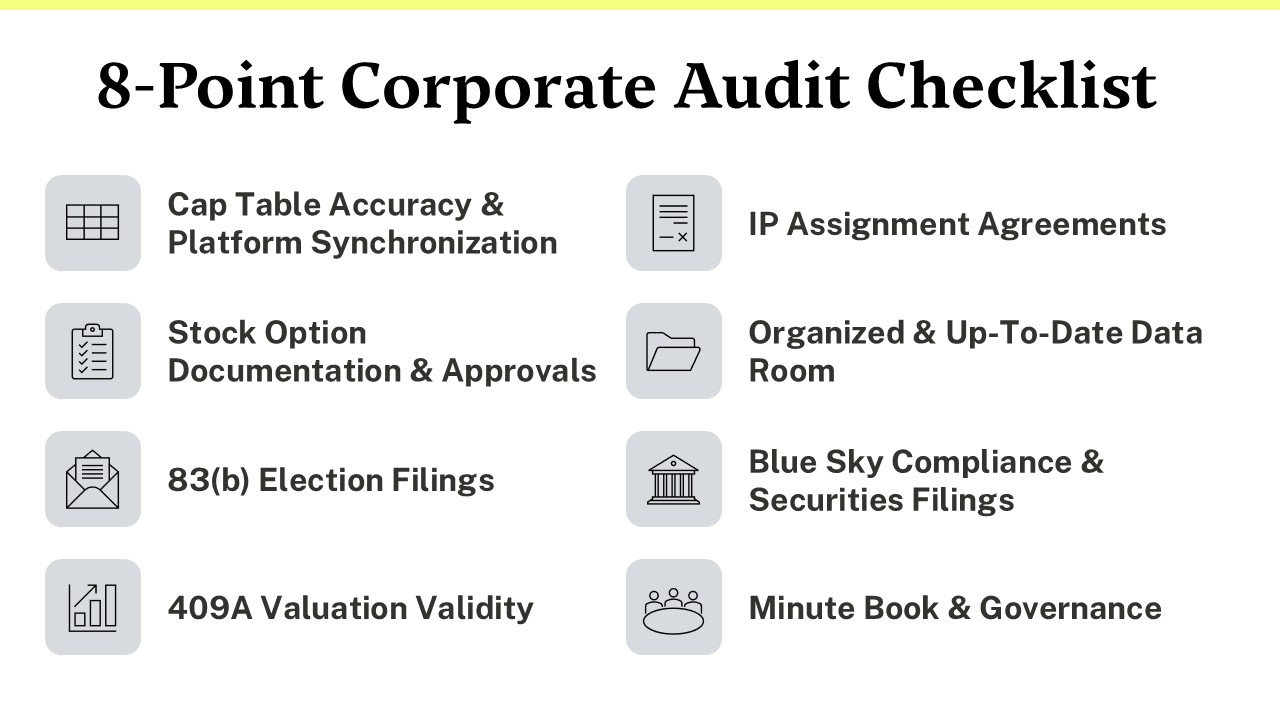

Why Start-Ups Should Conduct an Annual Corporate Audit

Beginning the year with a corporate audit enables startups to address critical compliance gaps and organize essential records. When venture funding or M&A opportunities arise, prepared companies can execute decisively.

Basics of Founder Compensation (Part I): A Guide to “Founder Stock”

In Part 1 of our Founder Compensation Series, we break down the importance of issuing founder equity properly from the start. We explain the key timing considerations, the 83(b) election that cannot be missed, and how to structure vesting and acceleration to balance co-founder and investor interests.

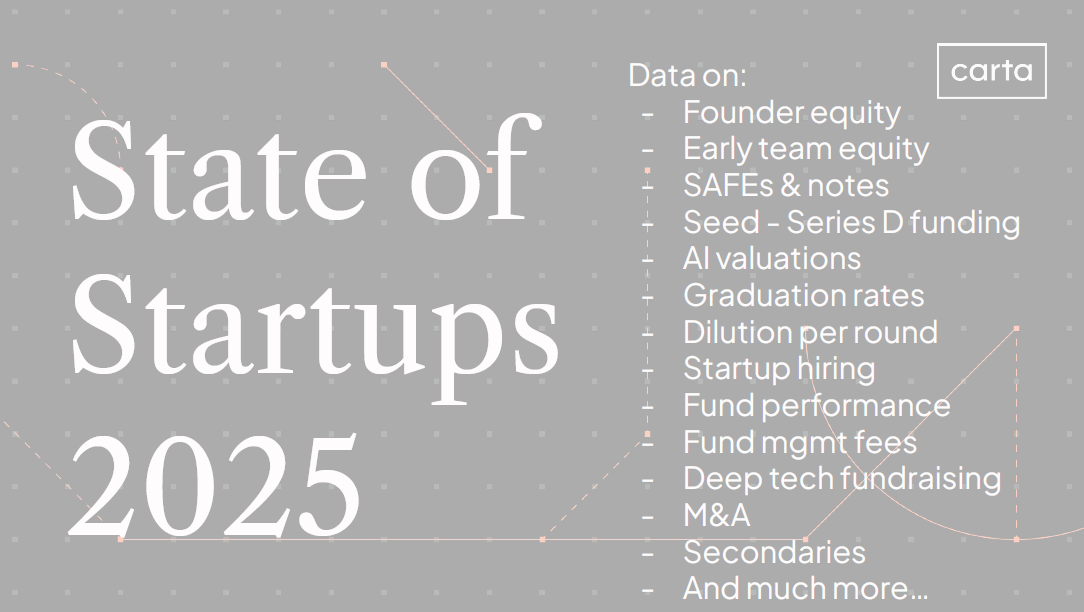

10 Data-Driven Startup Trends Shaping 2026

Carta's comprehensive 2025 State of Startups report provides a data-rich roadmap for navigating the year ahead. Here are the ten critical trends every founder and investor should understand.

Tips to Close Your Fundraise by End of Year

Companies who have their legal and operational infrastructure ready for a financing are more likely to close quickly.

The Human-AI Partnership: Four Principles of Responsible AI Use in Legal Practice

Discover how responsible AI integration empowers modern legal counsel to deliver faster, more secure, and more strategic advice without sacrificing professional judgment.