Why Start-Ups Should Conduct an Annual Corporate Audit

January presents both a fresh start and a strategic window for corporate housekeeping. This is the kind of clean-up that can mean being able to close a term sheet in three weeks instead of three months because a company’s documentation is already dialed in. Investors return from holiday break ready to deploy capital, and M&A conversations that started in Q4 may accelerate into term sheets. The companies that move fastest are the ones that already have their corporate house in order.

The Importance of Corporate Hygiene

In the startup world, velocity is currency. When a strategic acquirer comes calling or a lead investor wants to move quickly on a financing, due diligence delays can kill momentum (or the deal entirely). Promising transactions can stall over missing 83(b) election filings, incomplete cap tables, and unsigned IP assignment agreements. Beyond timing, there's potential valuation impact, as buyers and investors often discount or expect concessions for discovered problems.

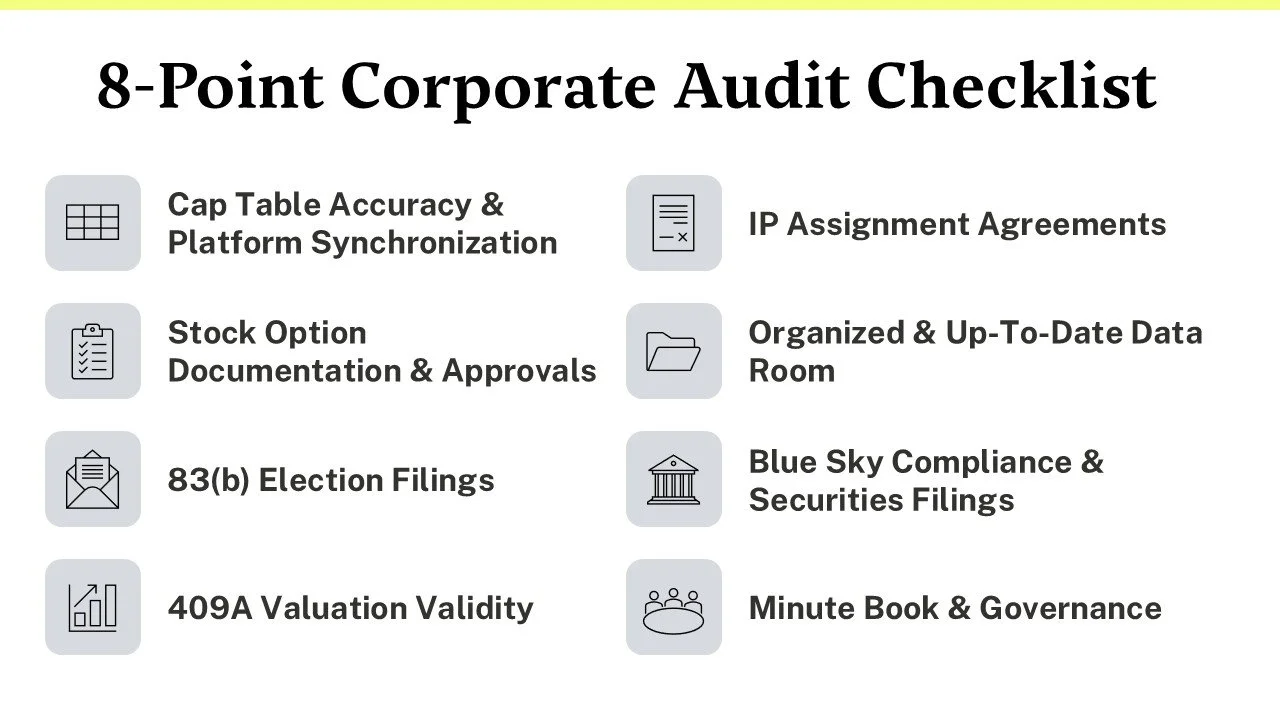

8-Point Corporate Audit Checklist

To help founders and companies start the year off right, we’ve prepared a checklist of key action items to ensure the company’s records are in good shape.

-

The cap table is a company’s equity source of truth. If the platform shows different numbers than what’s in the company’s corporate records, they need to be reconciled immediately.

Action items:

Pull current reports from the company’s cap table platform (Carta, Pulley, etc.)

Reconcile against board resolutions and the stock ledger

Verify all option grants, exercises, and transfers are accurately reflected

Update stakeholder contact information and addresses

-

Every stock option grant requires proper board authorization. Missing or defective approvals create significant liability. Creating a master spreadsheet linking each grant to its corresponding board approval and signed agreement can save hours during due diligence.

Action items:

Confirm written board consent or meeting minutes exist for every grant

Verify all option agreements are fully executed by both company and recipient

Check that exercise prices match the 409A valuation in effect at grant date

Ensure grants comply with the equity incentive plan's share reserve

-

The 83(b) election is a 30-day IRS deadline that, if missed, can cost founders and early employees tens or hundreds of thousands in unnecessary taxes. Under IRC Section 83(b), recipients of restricted stock must file within 30 days of the grant date to avoid taxation on future appreciation. Investors will ask about these in diligence and expect to see actual evidence of filing.

Action items:

Confirm all restricted stock recipients filed their 83(b) elections on time

Collect proof of filing: IRS-stamped copies, certified mail receipts, or delivery confirmations

Document any missed elections and model the tax implications

For current-year grants, implement a systematic tracking process

-

A 409A valuation determines the fair market value of the company's common stock for option pricing purposes. Under IRC Section 409A, the IRS provides safe harbor protection for valuations prepared by a qualified independent appraiser that are less than 12 months old (or have not been invalidated by a material event).

Action items:

Check the date of the company's most recent 409A valuation

Identify any material events that would require a new valuation: funding rounds, significant revenue changes, M&A discussions, or major market shifts

If the valuation is approaching 12 months old, schedule a refresh

-

Every person who touches the company's IP (founders, employees, contractors, advisors) should have a signed an agreement that assigns inventions to the company and protects confidential information. For employees, those agreements are Confidential Information and Invention Assignment Agreements (CIIAAs) or similar agreements. For consultants and advisors, IP assignment provisions are often included in consulting or advisor agreements themselves. Missing CIIAAs are a critical diligence issue, as they raise fundamental questions about whether the company actually owns its technology.

Action items:

Pull a complete list of everyone who has ever worked for or with the company

Cross-check against signed CIIAA and IP assignment records

Identify and immediately address any gaps

For current employees, make signing a condition of continued employment

For departed employees or contractors, attempt to obtain retroactive signatures (with counsel guidance)

-

The company’s virtual data room should be investor-ready at all times, not something the team scrambles to assemble when a term sheet arrives. A well-organized data room can cut diligence time in half.

Action items:

Update with recent board materials, financial statements, and material contracts

Organize by standard categories: Corporate, Intellectual Property, Employment, Commercial Contracts, Compliance, Financials

Remove outdated or superseded documents (but maintain version history)

Ensure all material agreements are included: customer contracts, vendor agreements, leases, loan documents

Create a comprehensive index

-

Federal and state securities laws require specific filings when a company issues equity (covering everything from a formal financing round to a single option grant). Missing filings in a financing can create rescission rights, meaning investors could theoretically demand their money back. While enforcement is rare, this is low-hanging fruit that sophisticated investors will flag in diligence.

Action items:

Verify Form D filings with the SEC for all financing rounds

Confirm state securities (blue sky) filings in all required jurisdictions

Address any missed or late filings with securities counsel

Implement a process to ensure timely filing for future issuances

-

A company's minute book is the legal record of all corporate actions. Incomplete records create ambiguity about what was actually authorized.

Action items:

Ensure written consents or meeting minutes exist for all board and stockholder actions

Confirm all Charter amendments were properly filed with the Secretary of State where the company is incorporated

Review board and officer composition to confirm whether all directors and officers were properly appointed and still serving

Check committee structures (audit, compensation) and charters if applicable

Action Plan: From Audit to Execution

This Week

Schedule an internal audit kickoff with the company's finance team and legal counsel

Request current cap table reports and equity grant logs

Gather the company’s most recent board materials and corporate records

Next 30 Days

Work through the 8-point checklist systematically

Create a remediation list for any identified gaps

Prioritize fixes based on risk level and upcoming business needs (fundraising, M&A discussions, etc.)

Engage outside counsel for complex issues like missed 83(b) elections or securities compliance gaps

Ongoing Best Practices

Quarterly: Reconcile the cap table against corporate records

Real-time: Update the data room when material documents are executed

Annually: Refresh the 409A valuation and run this full audit

Every hire: Collect signed CIIAAs before day one

Preparation Enables Velocity

Start-ups operate under real time and capital constraints, often without the luxury of perfect processes. But the objective of corporate hygiene is not perfection or box-checking for its own sake. It’s about preserving optionality and enabling speed. When the right opportunity arises (whether a financing, strategic partnership, or acquisition), companies should be positioned to act decisively, focusing on execution rather than untangling historical issues. For companies entering the year with ambitious plans, January is an ideal time to take control of what is within their control and set the foundation for efficient growth.